Regulation on the adequacy of own resources of institutions, groups of institutes, financial holding groups and mixed financial holding groups (Solvency Regulation-SolvV)

Unofficial table of contents

Solvv

Date of completion: 06.12.2013

Full quote:

" Solvency regulation of 6 December 2013 (BGBl. I p. 4168) "

| Replaced V 7610-2-29 v. 14.12.2006 I 2926 |

For more details, please refer to the menu under

Notes

Footnote

(+ + + Text evidence from: 1.1.2014 + + +)

(+ + + For application cf. § 1 and § 38 + + +)

(+ + + Official note from the norm-provider on EC law:

Implementation of the

EURL 36/2013 (CELEX Nr: 32013L0036)

Adjustment of the

EUV 575/2013 (CELEX Nr: 32013R0575) + + +)

Unofficial table of contents

Input formula

On the basis of § 10 (1) sentence 1 and 3 of the Banking Act, which is defined by Article 1 (21) of the Law of 28 August 2013 (BGBl. 3395), as well as under Article 10a (7) sentences 1 and 3 of the Banking Act, which is defined by Article 1 (22) of the Law of 28 August 2013 (BGBl). 3395), in consultation with the Deutsche Bundesbank, and after hearing the top associations of the institutes, the Federal Ministry of Finance is responsible for:

Unofficial table of contents

Content Summary

Part 1General provisions

| § 1 |

Scope |

| § 2 |

Applications and advertisements |

Part 2More provisions on the own resources requirements for institutions and Group Chapter 1Internal Ansetching Section 1General Provisions

| § 3 |

Tests on the use of a permit-based approach to the determination of minimum own-resource requirements |

| § 4 |

Measures in the event of deficiencies in the detection of risks or of non-compliance with the requirements for the use of a permit-based approach to the determination of minimum own-resource requirements |

| § 5 |

Calculations and notifications for the prudential benchmarking exercise in the application of internal approaches |

| § 6 |

Supervisory benchmarking of internal approaches |

Section 2Supplementary

Rules on the IRB Approach

| § 7 |

IRB approach-aptitude tests for internal rating systems and participation risk models |

| § 8 |

Period for the implementation of the IRB Approach |

| § 9 |

Requirements for the implementation of the IRB approach |

| § 10 |

IRB approach threshold; visible reference point |

| § 11 |

Calculation of the coverage degree |

| § 12 |

IRB approach positions to be taken into account in the coverage level meter |

| § 13 |

Positions to be taken into account in the denominator for the degree of coverage; total coverage for the coverage level |

| § 14 |

Discontinued operations; new business; inventory to be taken into account |

| § 15 |

Permanent exception to the application of the IRB approach to tax-raising churches and religious societies |

| § 16 |

Materiality threshold for the 90-day default |

| § 17 |

Eligible types of participations for the exemption from the application of the IRB approach until 31 December 2017 |

Section 3Supplementary arrangements for IMM

| § 18 |

IMM Eligibility Check |

Section 4Supplementary provisions

on internal grading procedures

| § 19 |

Suitability tests for internal classification procedures |

Section 5Supplementary provisions

on operational risks

Section 6Supplementary provisions

on internal models for market risks

| Section 21 |

Internal Models-Owner Review |

Chapter 2Preferences

for the assessment of the asset value

| Section 22 |

Guidelines for the assessment of the investment value of real estate |

Chapter 3More provisions

on transitional provisions

for the own resources requirements

| Section 23 |

Percentage of capital ratios |

Part 3More provisions

for the determination of the own resources chapter 1More provisions

on transitional provisions

for the determination of own resources

| § 24 |

Percentages for taking into account unrealised losses of assets or liabilities recorded in the balance sheet, which are valued at fair value |

| Section 25 |

Percentages for taking into account unrealised gains from assets or liabilities recognised in the balance sheet, which are valued at fair value |

| Section 26 |

Percentage for deductions from hard core capital, additional core capital and supplementary capital |

| § 27 |

Percentage for the recognition of instruments and positions in hard core consolidated capital which are not applicable as minority holdings |

| § 28 |

Factors for the recognition of minority shareholdings and qualifying additional core capital as well as supplementary capital |

| § 29 |

Percentage of deductions provided for in Articles 32 to 36, 56 and 66 of Regulation (EU) No 575/2013 |

| § 30 |

Percentage of the adjustment referred to in Article 36 (1) (i) and 49 (1) and (3) of Regulation (EU) No 575/2013 |

| Section 31 |

Percentage limits on the limits of the instruments of the hard core capital, additional core capital and additional capital referred to in Article 484 (3) to (5) of Regulation (EU) No 575/2013. |

Chapter 2Treatment of the

according to the equivalence method

rated participations in groups

| Section 32 |

Treatment of participations assessed in accordance with the equivalence method in the application of the procedure in accordance with Section 10a (5) of the Banking Act |

Part 4More provisions on

anti-cyclical capital buffers and

Combined Capital Buffer Request Chapter 1Anti-cyclical Capital Buffer

| § 33 |

Determination of the quota for the domestic counter-cyclical capital buffer |

| Section 34 |

Publication of the quota |

| § 35 |

Additional publications for quotas in third countries |

| § 36 |

Significant risk positions |

Chapter 2Combined

Capital Buffer Request

| Section 37 |

Maximum payout amount |

Part 5Transition and final provisions

| § 38 |

Transitional provisions |

| § 39 |

Entry into force, external force |

Part 1

General provisions

Unofficial table of contents

§ 1 Scope

(1) § § 3 to 23 of this Regulation are supplementary to Articles 92 to 386 of Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and on the Amendment of Regulation (EU) No 646/2012 (OJ L 206, 22.7.2012). 1) should be applied by those institutions and groups which are obliged to comply with the provisions of this Article in accordance with Regulation (EU) No 575/2013 or under the Banking Act. (2) § § 24 to 31 of this Regulation are supplementary apply to Articles 25 to 91 of Regulation (EU) No 575/2013 by those institutions and groups which, in accordance with Regulation (EU) No 575/2013 or under the Banking Act, have to comply with the provisions of this Article. (3) § 32 of these Articles In addition to Articles 11 to 91 of Regulation (EU) No 575/2013, the Regulation shall be supplemented by (4) Articles 33 to 37 of this Regulation shall be supplementary to § § 10c to 10i of the German Banking Act ("§ § 10c bis 10i"). To apply the law on loans to those institutions and groups which are obliged to comply with the provisions of these rules.

Unofficial table of contents

§ 2 Applications and advertisements

(1) Applications submitted under Regulation (EU) No 575/2013 to the Bundesanstalt für Finanzdienstleistungsaufsicht (Bundesanstalt für Finanzdienstleistungsaufsicht, Bundesanstalt) as the competent authority shall be subject to any other provisions in written form at the (2) Ads according to Regulation (EU) No. 575/2013, for which the Federal Institute is the competent authority, must be submitted to the Bundesanstalt and copy to the Deutsche Bundesbank. (3) Notifications which are due to regular reports Reporting obligations under Regulation (EU) No 575/2013 in relation to the Federal Agency as the competent authority, must be submitted via the Deutsche Bundesbank.

Part 2

More detailed provisions on own resources requirements for institutions and groups

Chapter 1

Internal approaches

Section 1

General provisions

Unofficial table of contents

§ 3 Examination of the use of a permit-based approach to the determination of minimum own-resource requirements

(1) Where the Bundesanstalt has granted an institution permission to use an approach to determine the minimum requirements for own resources, the use of which is authorised by the institution in accordance with Articles 92 to 386 of Regulation (EU) No 575/2013. The competent authority must regularly verify that the requirements for this approach are met in accordance with this Regulation and in Regulation (EU) No 575/2013 (the requirement for a permit to identify the minimum requirements for own resources) is met. . The review shall take place at least every three years. In addition, the Bundesanstalt is examining whether any deficiencies are subject to any shortcomings and requirements. (2) The Federal Institute may carry out the aptitude test for the permission to use an approach as well as the regular Review and review on the basis of an examination in accordance with § 44 (1) sentence 2 of the Banking Act. The examination in accordance with § 44 (1) sentence 2 of the German Banking Act (Kreditwesengesetz) usually carries out the Deutsche Bundesbank. (3) In the course of the review, the Federal Institute shall take into account, in particular, changes in the activities of the Institute and the application. this permitted approach to the identification of the minimum own resources requirements for new products. In addition, it will check whether the Institute applies sophisticated and current techniques and practices for this approach. (4) In the review, the Federal Institute shall take into account the analyses and benchmarks of the European Banking Authority.

Footnote

(+ + + § 3: For application see § 1 (1) (1) + + +)

Unofficial table of contents

§ 4 Measures in the event of defects in the collection of risks or non-compliance with the requirements for the use of a permit-based approach to the determination of the minimum own-resources requirements

(1) Provided that the Federal Institute determines that the design of a permit-based approach to determining the minimum property requirements by the Institute has significant deficiencies in the collection of the risk, the Federal Institute shall ensure that the institution is responsible for the assessment of the minimum requirements for the individual requirements. ensure that these deficiencies are remedied, or take appropriate measures to mitigate the consequences resulting from the shortcomings. Suitable measures are, in particular, the setting of higher multiplication factors or additional own-resource requirements. (2) In an internal model for market risks, which is permitted by the Federal Institute, the numerous occurrences of the 366 of Regulation (EU) No 575/2013 on the fact that the model is not or no longer accurate enough, the Bundesanstalt withdraws the permission to use this internal model for market risks or orders adequate Measures to ensure that the model is improved immediately (3) If an institution no longer fulfils all the requirements for a permit-based approach to the determination of the minimum own-resource requirements laid down in this Regulation and Regulation (EU) No 575/2013, the Bundesanstalt shall be required to:

-

1.

-

a plan by the Institute, how and in which period a timely return to rule compliance is to be ensured, or

-

2.

-

The Institute, in a manner satisfactory to the Bundesanstalt, proves that the effects of non-compliance with the requirements are insignificant, provided that this is permitted under Regulation (EU) No 575/2013 for this approach.

If the own resources requirements are likely to be insufficient in the case of the first sentence, the Bundesanstalt will assign additional own resources requirements, if appropriate. (4) It seems unlikely that the Bundesanstalt will be able to do so by the Federal Institute for the Environment. The Federal Institute shall require a repair of the plan in accordance with the first sentence of paragraph 3 of the first sentence of the first subparagraph of paragraph 3, which shall lead to the complete reinstatement of the requirements or the implementation period provided for by the Institute shall be required. (5) In the opinion of the Bundesanstalt, it seems unlikely that the if the institution is to meet the requirements within a reasonable period of time, and if the institution is permitted under Regulation (EU) No 575/2013 for this approach, it shall not provide a satisfactory proof of the insignificant nature of the The effect of non-compliance with the requirements laid down in paragraph 3, first sentence, point 2, must be given by the Federal Institute for the use of the approach by the Institute

-

1.

-

Total withdrawal or

-

2.

-

to those areas where compliance with the requirements is met or can be reached within a reasonable time, provided that this is within the limits laid down by the Federal Agency for the non-application of this Approach is possible.

In particular for risk-weighted position amounts in accordance with the approach based on internal assessments (IRB approach) within the meaning of Article 107 (1) of Regulation (EU) No 575/2013, the Federal Institute may separately apply for individual types of Credit risk exposures shall be subject to the agreement referred to in Article 143 (2) of Regulation (EU) No 575/2013 on the use of the IRB approach or on the use of own estimates of loss-of-loss ratios (LGDs) within the meaning of Article 4 (1) Point 55 of Regulation (EU) No 575/2013, or conversion factors for this type of Revoking credit risk positions.

Footnote

(+ + + § 4: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 5 Calculations and notifications for the prudential benchmarking in the application of internal approaches

(1) An institution which determines its own resources requirements on the basis of internal approaches has to calculate and report the own resources requirements once a year for those of its risk positions or positions which are in those internal approaches the relevant reference portfolios of the Bundesanstalt or of the European Banking Authority. This obligation of calculation and reporting does not apply to the extent that the own resources requirements are calculated with the advanced measurement approach referred to in Article 312 (2), first sentence, of Regulation (EU) No 575/2013. (2) The calculations and notifications referred to in paragraph 1 shall be carried out separately at the end of the calendar year and for each internal approach used by the institution. The results of these calculations shall be based on an explanation of the methods used in the determination of the results in each case up to the 30. Report on the business day after the end of a calendar year separately for reference portfolios of the Bundesanstalt and the European Banking Authority to the Deutsche Bundesbank as well as to the European Banking Authority. In this context, the technical implementing standards referred to in Article 78 (8) of Directive 2013 /36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activities of credit institutions and the supervision of credit institutions shall be Credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006 /48/EC and 2006 /49/EC (OJ L 136, 31.5.2006, p. 338). (3) The Bundesanstalt may determine the notification deadlines which differ from the first sentence of the first sentence of paragraph 1 and the first sentence of paragraph 2, or the second sentence of the second sentence of paragraph 2.

Footnote

(+ + + § 5: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 6 Supervision benchmarking of internal approaches

(1) The Bundesanstalt creates its own reference portfolios exclusively in coordination with the European Banking Authority. (2) The Bundesanstalt uses the information reported by the institutes in accordance with § 5 to the span of the to monitor risk-weighted position amounts and the own resources requirements for those risk positions or positions of a reference portfolio arising from the internal approaches of the notifiable institutions. (3) The Bundesanstalt shall assess at least annually the quality of these internal approaches and shall focus on: In particular:

-

1.

-

the internal approaches which have significant differences in relation to own resources requirements for the same risk position or position,

-

2.

-

the internal approaches, which have a particularly high or low diversity, and

-

3.

-

in cases of a significant and systematic underestimation of the own resources requirements.

(4) Give the monitoring referred to in paragraph 2 and the assessment referred to in paragraph 3 that the results of internal approaches of certain institutions differ significantly from the results of the majority of institutions, or that there are few similarities in the internal approaches to the internal approaches. The Federal Institute investigates the reasons for this, so that a wide range of results can be achieved. If it can be clearly established that the internal approach of an institution leads to an underestimation of the own resources requirements which are not attributed to differences in the underlying risks of risk positions or positions , the Federal Agency shall take appropriate remedial measures. In deciding on the appropriateness of remedies, the objectives pursued through the use of internal approaches shall be taken into account and shall ensure that corrective action is taken to

-

1.

-

do not lead to standardization or preferred methods,

-

2.

-

do not create false incentives and

-

3.

-

do not cause herd behavior.

Footnote

(+ + + § 6: For application, see § 1 (1) (1) + + +)

Section 2

Supplementary rules on the IRB approach

Unofficial table of contents

§ 7 IRB-Approach-suitability tests for internal rating systems and participation risk models

(1) The Federal Institute shall decide on the authorisation to use the IRB Approach as referred to in Article 143 (2) and on the changes to be made pursuant to Article 143 (3) of Regulation (EU) No 575/2013 (IRB Approach-suitability test). the basis of an examination in accordance with § 44 (1) sentence 2 of the Banking Act. The audit pursuant to § 44 (1) sentence 2 of the German Banking Act (Kreditwesengesetz) usually carries out the Deutsche Bundesbank. IRB-Approach-suitability tests will only be carried out by the Federal Institute when the Institute

-

1.

-

with the rating systems declared for the IRB Aptitude Test, and the rating systems which the Institute may already use for the IRB Approach, the overall IRB approach entry threshold in accordance with § 10, paragraph 1, is reached or exceeded,

-

2.

-

in respect of each of the credit rating systems and risk models notified to the IRB aptitude test, the use requirements referred to in Article 144 (1) (f) of Regulation (EU) No 575/2013 have been met and, in the case of a rating system, the Experience requirements referred to in Article 145 of Regulation (EU) No 575/2013 have been met to enable the full implementation of the experience requirements up to the intended date of use of the rating system,

-

3.

-

for each of the rating systems and participating risk models notified to the IRB approach aptitude test, the new business in accordance with Article 14 (1), second sentence, point 1, and at least a significant part of the stock business to be taken into account in accordance with Section 14 (1) (a) 2 has recorded with this rating system or risk of equity risk; and

-

4.

-

it is possible to demonstrate that the use of the IRB approach to the IRB-based approach to the IRB-based approach to the IRB-based approach to the IRB-based approach is to be complied with in accordance with the implementation plan.

(2) Within the framework of an IRB-aptitude test, which is carried out according to the previously granted permission of the Institute for the IRB Approach, the Federal Institute also assesses whether the Institute has approved the implementation plan approved for the IRB approach. (3) In the event of significant changes in credit rating systems or participation risk models, an institution shall, before using the amended rating system or participation risk models, vote in favour of the IRB approach with the Federal Institute, whether the Bundesanstalt the assessment of the institute that it is not an essential The amendment shall be subject to the requirement of the Bundesanstalt's permission in accordance with Article 143 (3) (b) of Regulation (EU) No 575/2013.

Footnote

(+ + + § 7: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 8 Period for the implementation of the IRB Approach

(1) The maximum period to be determined by the Bundesanstalt in accordance with Article 148 (2) of Regulation (EU) No 575/2013, in which the IRB approach is to be implemented, shall always be five years. It begins as soon as the Federal Institute has allowed the Institute to use the IRB approach (IRB-Approach-Approval). (2) The period during which the ability to determine the own-resource requirements using the Credit risk management (KSA) is to be maintained in accordance with Article 148 (4) of Regulation (EU) No 575/2013, starts with the IRB Approach and ends with the obvious reference point in accordance with § 10 paragraph 2 for the implementation of the IRB-Approach. (3) Has an Institute already an IRB Approach-Approval based on a Implementation Plan , according to which it applies to all credit risk exposures for which the institution uses the IRB Approach (IRB Approach positions), which are not of the exposure class quantity business referred to in Article 147 (2) (d) of Regulation (EU) No 575/2013 , no own estimates of LGD or conversion factor are used, and the Institute has already reached the IRB-Approach-Exit threshold in accordance with Article 10 (3) on the basis of this implementation plan, then the same shall apply to a subsequent implementation plan, according to which the institute for such IRB approach positions own Estimates of the LGD or conversion factor used in the period referred to in paragraph 2 shall be deemed to have been completed.

Footnote

(+ + + § 8: For application cf. § 1 (1) (1) + + +)

Unofficial table of contents

§ 9 Requirements for the implementation of the IRB Approach

(1) In the implementation of the IRB approach, an institution must meet the requirements of paragraphs 2 to 4; these requirements shall constitute the requirements to be specified in accordance with the first sentence of Article 148 (3) of Regulation (EU) No 575/2013. (2) For the Credit risk exposures of the Institute

-

1.

-

at the time of the IRB approach approval, the IRB approach entry threshold has already been reached,

-

2.

-

At the latest after two and a half years, the obvious reference point for the implementation of the IRB approach has been reached,

-

3.

-

until the end of the maximum permissible period for the implementation of the IRB approach, the IRB approach exit threshold has been reached.

(3) Once thresholds have been reached, it is necessary to continue to comply. (4) If the Institute has already received an IRB-Approach on the basis of a conversion plan, according to which it is for IRB-Approach positions other than the receivables class. in accordance with Article 147 (2) (d) of Regulation (EU) No 575/2013, no own estimates of the LGD or conversion factor are used, and the Institute has already provided the basis for the implementation of this implementation plan, IRB-approach-exit threshold reached, then the institute has to follow a subsequent Implementation plan, according to which it uses own estimates of LGD or conversion factor for such IRB approach positions, until the Federal Institute has established that the supervisory reference point has been reached, to ensure that it is Position amounts in the IRB approach (risk-weighted IRB-approach-position amounts) for these IRB approach positions can be determined without using own estimates of LGD or conversion factor.

Footnote

(+ + + § 9: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 10 IRB-Approach-threshold; visible reference point

(1) The IRB approach threshold is reached if the credit risk exposures of the Institute are both the coverage level for IRB approach position values and the coverage level for risk-weighted IRB approach position amounts with appropriate Rating systems and participation risk models are at least 50 percent in each case. (2) The obvious reference point is achieved if the coverage level for IRB approach position values and the coverage level for risk-weighted IRB approach-Position amounts with appropriate rating systems and Participation risk models are at least 80 per cent in each case. (3) The IRB approach exit threshold is reached if the degree of coverage for IRB-approach values according to § 11 (1) and the coverage level for risk-weighted IRB approach-Position amounts according to § 11 (2) with appropriate rating systems is at least 92 per cent each. The Federal Institute may reduce the percentage of the IRB approach-exit threshold for an institution upon request, if the Institute has set out important reasons for this.

Footnote

(+ + + § 10: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

Section 11 Calculation of the degree of coverage

(1) The degree of coverage for IRB-Approach-Position values is the quotient of

-

1.

-

the sum of the IRB approach position values for all IRB approach positions which may be taken into account in the coverage level in accordance with § 12, but for IRB approach positions in accordance with § 13 (4) (2) (a) only in the amount referred to in paragraph 4 eligible percentage of IRB approach position value, and

-

2.

-

the sum of the KSA position values for all KSA positions and the IRB approach position values for all IRB line positions, which are to be taken into account in the denominator for the coverage level in accordance with § 13.

(2) The degree of coverage for risk-weighted IRB-Approach-Position amounts is the quotient of:

-

1.

-

the sum of risk-weighted IRB approach positions for all IRB approach positions which may be taken into account in the coverage level in accordance with § 12, but for IRB approach positions in accordance with Article 13 (4) (2) (a) only in The level of the risk-weighted IRB approach to be taken into account in accordance with paragraph 5, in so far as these risk-weighted IRB-approach-position amounts are used in determining the overall risk exposure under Article 92 (3) of the Regulation (EU) No 575/2013, or in the determination of the the hard core capital has been deducted under Article 36 (1) (k) of this EU Regulation; and

-

2.

-

the sum of the risk-weighted PNA-position amounts for all KSA positions and risk-weighted IRB-approach positions for all IRB-Approach positions to be taken into account in accordance with § 13 in the denominator for the degree of coverage, in so far as these risk-weighted position amounts are taken into account in the determination of the overall risk exposure referred to in Article 92 (3) of Regulation (EU) No 575/2013, or in the determination of the hard core capital referred to in Article 36 (1) (1) This EU regulation has been deducted.

In order to determine the levels of coverage referred to in paragraphs 1 and 2, the position values and the risk-weighted position amounts shall be determined in accordance with the procedure to be followed at that time for each of the risk positions according to the implementation plan. (4) The percentage of IRB approach taken into account of an IRB approach according to Article 13 (4) (2) (a) shall be the quotient of the IRB Approach Position.

-

1.

-

the sum of the IRB approach position values for those credit risk positions of the securitised portfolio that the Institute has recorded with a rating system that the Institute with the consent of the Federal Institute pursuant to Article 143 (2) of the Regulation (EU) No 575/2013 should be used for the IRB approach, and

-

2.

-

the sum of the position values for all credit risk exposures of the securitised portfolio.

(5) The percentage of risk-weighted IRB approach taken into account of an IRB approach position according to Article 13 (4) (2) (a) shall be the quotient of the IRB approach

-

1.

-

the sum of the risk-weighted IRB approach-position amounts for those credit risk exposures of the securitised portfolio that the institution has recorded with a rating system that the Institute with the approval of the Bundesanstalt pursuant to Article 143 (2). Regulation (EU) No 575/2013 should be used for the IRB approach, and

-

2.

-

the sum of the risk-weighted position amounts for all credit risk exposures of the securitised portfolio.

Footnote

(+ + + § 11: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 12 IRB-Approach positions to be taken into account in the counter for the degree of coverage

(1) Where the Institute for relevant types of risk positions seeks to use own estimates of LGDs or conversion factors, the IRB positions to be taken into account in the numerator shall be determined in accordance with paragraph 2, point 2, otherwise. referred to in paragraph 2 (1). According to the first sentence, relevant types of risk positions are all IRB approach positions, which are the IRB approach-exposure class of central governments, institutes or companies under Article 147 (2) (b), (c) and (d) of Regulation (EU) No 575/2013 , with the exception of

-

1.

-

Risk exposures resulting from purchased receivings;

-

2.

-

Special financing positions in accordance with Article 147 (8) of Regulation (EU) No 575/2013, in respect of which the Institute has chosen to use the risk weight categories referred to in Article 153 (5) of this EU Regulation, and

-

3.

-

Risk positions to be attributed to debt securities covered by Article 112 (l) of Regulation (EU) No 575/2013 when the standard rate of credit risk is applied to the exposure class and to which the institution shall, in accordance with a uniform choice, be assigned For all such IRB approach positions, it does not intend to use own estimates of LGD and conversion factor.

(2) In the counter for a degree of coverage,

-

1.

-

if the institution does not seek to use own estimates of the LGD or conversion factor for any of the types of risk exposures referred to in the second sentence of paragraph 1, all risk exposures belonging to the population for the degree of coverage , which have been covered by credit rating systems or participation risk models, which the Institute may use for the IRB approach with the consent of the Bundesanstalt in accordance with Article 143 (2) of Regulation (EU) No 575/2013, and for which: all risk parameters to be used to determine the the risk-weighted IRB approach-the position amount of the risk position at least must be estimated;

-

2.

-

if, in accordance with the second sentence of paragraph 1, there are relevant types of risk exposures for which the Institute is seeking the use of own estimates of LGD or conversion factor, all risk positions belonging to the population for the degree of coverage shall be taken into account,

-

a)

-

if they belong to the types of risk exposures relevant in accordance with the second sentence of paragraph 1, they have been covered by credit rating systems which the Institute, with the consent of the Bundesanstalt pursuant to Article 143 (2) of Regulation (EU) No 575/2013, for the IRB Approach and which may be used both to estimate the PD within the meaning of Article 4 (1) (54) of Regulation (EU) No 575/2013 and to estimate the LGD and, where applicable, the conversion factor, or

-

b)

-

if they do not belong to the types of risk exposures relevant in accordance with the second sentence of paragraph 1, have been covered by credit rating systems or participation risk models which the Institute, with the consent of the Bundesanstalt pursuant to Article 143 (2) of the Regulation, (EU) No 575/2013 for the IRB approach, and for which all risk parameters are estimated which have to be estimated at least for themselves in order to determine the risk-weighted IRB approach position amount of the respective risk position.

(3) The decision determining the areas of business for which the risk exposures should be taken into account in accordance with Article 142 (1) (3) of Regulation (EU) No 575/2013 in the event of the existence of the conditions referred to in paragraph 2 shall be at the Institute ' s disposal. It must be carried out in a uniform manner for all risk positions belonging to the new business or the stock business to be taken into account in a business unit, and shall be set out in the implementation plan. IRB approach-headings of the stock business of a business unit to be taken into account may not be taken into account in the meter for a coverage level until all of those IRB-approach positions referred to in paragraph 2 in the counter for the The degree of coverage may be taken into account.

Footnote

(+ + + § 12: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 13 Positions to be taken into account in the denominator for the degree of coverage; total coverage for the degree of coverage

(1) In the denominator for a degree of coverage, all IRB-approach positions and KSA positions shall be taken into account, belonging to the overall coverage level. (2) All KSA positions shall be included in the coverage level. IRB approach positions, with the exception of

-

1.

-

Participation positions in accordance with Article 147 (2) (e) of Regulation (EU) No 575/2013,

-

2.

-

Securitisation positions in accordance with Article 4 (1) (62) of Regulation (EU) No 575/2013,

-

3.

-

other credit-related assets as referred to in Article 147 (2) (g) of Regulation (EU) No 575/2013,

-

4.

-

Risk exposures in the form of a share in an undertaking for collective investment (OGA) within the meaning of Article 4 (1) (7) of Regulation (EU) No 575/2013,

-

5.

-

Risk positions exempted from the application of the IRB approach without any time limit following the decision of the Institute in accordance with Article 150 of Regulation (EU) No 575/2013,

-

6.

-

Risk positions of a group-affiliated undertaking which is not the competent institution for compliance with the own resources requirements on a summary basis of the group referred to in Article 11 (1) or (2) of Regulation (EU) No 575/2013, and for the Bundesanstalt has established that, prior to the entry into force of this Regulation, there have been important reasons for not taking into account those risk positions,

-

7.

-

risk exposures belonging to a transitional, exceptional type of credit risk position; or

-

8.

-

Risk positions for which, in accordance with Article 107 (2), first sentence, of Regulation (EU) No 575/2013 for the calculation of risk-weighted position amounts, the treatment referred to in Chapter 6 (9) is to be applied.

(3) In accordance with paragraph 2, first sentence, point 7, a type of credit risk position as referred to in Article 142 (1) (2) of Regulation (EU) No 575/2013 is acceptable if the Federal Institute for the Disposal of the Financial Services (Bundesanstalt)

-

1.

-

noted that there are important reasons set out by the Institute not to take account of these types of credit risk exposures in the overall coverage level,

-

2.

-

agreed to a plan submitted by the institution, the implementation of which shall, over a reasonable period, lead to the omission of the reasons for the non-consideration of this type of credit risk position as specified in point 1.

An important reason referred to in the first sentence of paragraph 1 shall be, in particular, where the credit risk exposures are

-

1.

-

have been established by the business of a business unit referred to in Article 142 (1) (3) of Regulation (EU) No 575/2013, at the time when the Institute of the Federal Institute has submitted its implementation plan for the IRB Approach, nor was not part of the business units of the Institute, and

-

2.

-

are not included in the scope of a rating system or risk models which the Institute may already use for the IRB Approach with the consent of the Federal Institute pursuant to Article 143 (2) of Regulation (EU) No 575/2013, or it intends to use its implementation plan for the IRB approach approved by the Federal Agency.

(4) In compliance with the requirements of § 11 (3), an institution may additionally take into account the following IRB approach positions in the population of the population for the degree of coverage:

-

1.

-

IRB approach positions to be attributed to the exposure class participations in accordance with Article 147 (2) (e) of Regulation (EU) No 575/2013 and by means of a rating system or participation risk models which the Institute, with the consent of the The Bundesanstalt pursuant to Article 143 (2) of Regulation (EU) No 575/2013 may have been used for the IRB Approach,

-

2.

-

Securitisation positions referred to in Article 4 (1) (62) of Regulation (EU) No 575/2013, for which the Institute is responsible for:

-

a)

-

uses the prudential formula approach referred to in Article 262 of Regulation (EU) No 575/2013 and has recorded credit risk exposures of the securitised portfolio with a credit rating system that the Institute, with the consent of the Federal Institute, has adopted pursuant to Article 143 Paragraph 2 of Regulation (EU) No 575/2013 may be used for the IRB Approach, or

-

b)

-

uses, with the consent of the Bundesanstalt, an internal classification procedure in accordance with Article 259 (3) and (4) of Regulation (EU) No 575/2013,

-

3.

-

Risk positions in the form of a share in an OGA within the meaning of Article 152 of Regulation (EU) No 575/2013, which the Institute has taken into account in accordance with the first sentence of Article 152 (1) of this EU Regulation, using the methods of the IRB Approach,

-

4.

-

Risk exposures exempted from the application of the IRB Approach by the Institute in accordance with Article 150 (1) (d) to (j) of Regulation (EU) No 575/2013, using the KSA in the determination of the total risk of exposure to the risk of exposure to the risk of exposure to the risk of exposure to the risk of exposure to the risk of exposure to the Article 92 (3) of Regulation (EU) No 575/2013 shall be taken into account, provided that the Institute

-

a)

-

these risk positions have been recorded using credit rating systems or participation risk models which, with the consent of the Bundesanstalt pursuant to Article 143 (2) of Regulation (EU) No 575/2013, may be used for the IRB approach, and

-

b)

-

for these risk positions IRB-Approach-Risk weights and risk-weighted IRB-Approach-Position amounts determined as if the credit risk exposures were IRB-Approach positions.

(5) For risk exposures as referred to in paragraph 4, point 4, the institution shall have the IRB approach risk weights and risk-weighted IRB approach positions calculated in this way, instead of the PNA risk weights or risk-weighted CKSA position amounts for the Take into account the credit risk exposures concerned in the numerator and in the denominator for a coverage level.

Footnote

(+ + + § 13: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

Section 14 Discontinued operation; new business; inventory to be taken into account

(1) An out-of-date business unit is a business unit in accordance with Article 142 (1) (3) of Regulation (EU) No 575/2013, in which the institution neither enters into new credit risk exposures through the conclusion of new transactions nor to enter into new credit risk management intended. For a business unit which is not a running business and whose risk positions are covered by the scope of application of Article 143 (3), second sentence, of Regulation (EU) No 575/2013, according to the Institute's implementation plan for the IRB Approach extending the rating system to be used,

-

1.

-

new business from the transactions resulting from the use of this rating system in order to comply with the verification requirements referred to in Article 144 (1) (f) of Regulation (EU) No 575/2013; and

-

2.

-

the stock business from the transactions falling within the scope of the rating system and not part of the new business.

(2) Inventory business to be taken into account is the stock business of a non-expelling business unit that is not an inventory-capable stock business. Exceptional stock business is the stock business of a non-running business unit, for which the Institute

-

1.

-

demonstrated to the Bundesanstalt that the collection of the rating system to be used for the IRB approach to the IRB approach would at present constitute a disproportionately high cost compared to the effort required by the the Institute for the collection of comparable stock business with a rating system is normally operated, and

-

2.

-

based on this decision, it has decided not to record the entire stock business at present with the rating system to be used for the IRB approach for this business.

Footnote

(+ + + § 14: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

§ 15 Permanent exception to the application of the IRB approach to tax-raising churches and religious societies

If the debtors are domestic churches or religious societies, which are in the legal form of a body of public law and which, pursuant to Article 140 of the Basic Law, in conjunction with Article 137 Paragraph 6 of the Weimar Reich constitution of 11 August 1919 (RGBl. 1383), the conditions for the permanent application of the KSA in accordance with Article 150 (1) (a) of Regulation (EU) No 575/2013 shall apply to the permanent application of the KSA to the tax-raising ecclesiastic bodies. a small number of significant debtors and a disproportionate effort for the introduction of a rating system without further proof than being fulfilled.

Footnote

(+ + + § 15: For application, see § 1 (1) (1) + + +)

Unofficial table of contents

Section 16 Materiality threshold for the 90-day default

Any liability of a debtor vis-à-vis the institution, its parent company or any of its subsidiaries shall be considered to be essential within the meaning of Article 178 (1) (b) of Regulation (EU) No 575/2013, if the debtor is responsible for the the current total debt exceeds the currently notified overall framework by more than 2.5 per cent, but at least by 100 euro. The current total debt is the sum of the amounts which the debtor currently owes to the institution or to a company belonging to the group to which the institution belongs, within the framework of all existing legal relationships. The present overall framework is the sum of the amounts currently made available to the debtor in the context of these legal relationships by the granting of credit and communicated, irrespective of their current use.

Footnote

(+ + + § 16: For application see § 1 (1) (1) + + +)

Unofficial table of contents

§ 17 Considerable types of participations for the exemption from the application of the IRB-Approach until 31 December 2017

For the transitional exception until 31 December 2017 from the application of the IRB approach in accordance with the provisions of Article 495 of Regulation (EU) No. 575/2013, an institution may, in accordance with the Bundesanstalt, be allowed to take all types of equity positions , which may not, in accordance with Article 150 (1) (g) and (h) of Regulation (EU) No 575/2013, be excluded from the application of the IRB approach.

Footnote

(+ + + § 17: For application, see § 1 (1) (1) + + +)

Section 3

Supplementary provisions on IMM

Unofficial table of contents

§ 18 IMM aptitude test

(1) The Federal Institute shall decide on the permission required under Article 283 (1) of Regulation (EU) No 575/2013 to use the method based on an internal model (IMM qualifying examination) on the basis of an examination in accordance with § 44 Paragraph 1, second sentence, of the Banking Act. The examination in accordance with § 44 (1) sentence 2 of the German Banking Act (Kreditwesengesetz) usually carries out the Deutsche Bundesbank. (2) Essential changes and extensions of the method (IMM) based on an internal model require a renewed permit. Paragraph 1 shall apply accordingly. In individual cases, the Bundesanstalt may agree to a change or extension in accordance with the first sentence without the prior IMM aptitude test, provided that the change or extension according to the assessment of the Bundesanstalt in coordination with the Deutsche Bundesbank also without The IMM aptitude test can be appropriately assessed. Significant and insignificant changes do not require a re-IMM aptitude test, but are to be reported in writing to the Bundesanstalt and the Deutsche Bundesbank; significant changes are made before the amended IMM is used with the Federal Institute for the Management of the Federal Republic of Germany. ,

Footnote

(+ + + § 18: For application see § 1 (1) (1) + + +)

(+ + + § 18 para. 2 sentence 1 italic print: superfluous word + + +)

Section 4

Supplementary rules on internal classification procedures

Unofficial table of contents

§ 19 suitability tests for internal classification procedures

(1) A permit for the application of an internal classification procedure pursuant to Article 259 (3) of Regulation (EU) No 575/2013 shall be granted by the Federal Office for each internal classification procedure which, after an aptitude test, is subject to the conditions of approval In accordance with Article 259 (3) of this EU Regulation, all securitisation positions falling within its scope are fully covered. Institutions shall state prior to the granting of a permit that they have sufficient experience with such internal procedures that substantially comply with the requirements of Article 259 (3) of Regulation (EU) No 575/2013 , and the scope of the application is essentially that of the internal classification procedure for which a permit has been requested. (2) suitability tests shall be carried out by the Federal Institute on the basis of Section 44 (1) sentence 2 of the Banking Act for each internal classification procedure,

-

1.

-

which has registered an institute for the aptitude test, and

-

2.

-

which an institution has used at the time of the aptitude test for a reasonable period of time as a relevant instrument for the measurement and management of the essential securitisation positions within the scope of the internal classification procedure , and from which the Institute is convinced that it is suitable for its purposes.

The examination in accordance with § 44 (1) sentence 2 of the German Banking Act (Kreditwesengesetz) usually carries out the Deutsche Bundesbank. (3) The scope of an internal classification procedure, which is to be determined by the institution, is determined by its risk properties, in particular the nature of securitised credit risk exposures on which a securitisation position is based, the characteristics of the securitisation position, the securitisation transaction or a securitisation programme, within the framework of which the securities, mainly in the form of money market documents with a A period of origin shall be issued for a maximum of one year (ABCP programme) or the available amount of data shall be constituted by the type of securitisation positions which can be determined by this internal classification procedure.

Footnote

(+ + + § 19: For application see § 1 (1) (1) + + +)

Section 5

Supplementary rules on operational risks

Unofficial table of contents

§ 20 AMA-qualifying examination

(1) The Federal Institute shall decide on the authorisation required under Article 312 (2), first sentence of Regulation (EU) No 575/2013 to use an advanced measurement approach (AMA qualifying examination) on the basis of an examination in accordance with § 44 Paragraph 1, second sentence, of the Banking Act. The examination pursuant to Section 44 (1), second sentence, of the German Banking Act (Kreditwesengesetz) usually carries out the Deutsche Bundesbank. (2) In the case of a renewed authorisation due to substantial changes and extensions of the advanced measurement approach referred to in Article 312 The second sentence of paragraph 2 of Regulation (EU) No 575/2013 shall apply in accordance with paragraph 1. In individual cases, the Bundesanstalt may agree to a change or extension according to sentence 1 without prior AMA aptitude test, provided that the change or extension according to the assessment of the Bundesanstalt in coordination with the Deutsche Bundesbank also without AMA aptitude test can be appropriately assessed. Significant and minor changes do not require a new AMA aptitude test, but are to be reported to the Bundesanstalt and the Deutsche Bundesbank in writing. Significant changes are to be agreed with the Federal Institute prior to the use of the amended advanced measurement approach.

Footnote

(+ + + § 20: For application, see § 1 (1) (1) + + +)

Section 6

Supplementary regulations on internal models for market risks

Unofficial table of contents

§ 21 Internal models-qualifying examination

(1) The Federal Institute shall decide on the permission required under Article 363 (1) of Regulation (EU) No 575/2013 to use internal models (internal models of aptitude test) on the basis of an examination in accordance with § 44 (1) sentence 2 of the Credit law. The examination pursuant to Section 44 (1), second sentence, of the Banking Act usually carries out the Deutsche Bundesbank. (2) For a renewed, extended or additional permit on the basis of substantial changes or extensions of internal models, in particular the addition of additional risk categories, in accordance with Article 363 (2) of Regulation (EU) No 575/2013, paragraph 1 shall in principle apply accordingly. In individual cases, the Bundesanstalt may agree to a change or extension in accordance with sentence 1 without prior internal model aptitude test, provided that the change or extension to be assessed in accordance with the assessment of the Federal Institute in coordination with the German Bundesbank can also be assessed appropriately without an internal model aptitude test. Significant and insignificant changes do not require a new internal model aptitude test, but are to be notified in writing to the Bundesanstalt and the Deutsche Bundesbank. Important changes are to be agreed with the Federal Institute before use of the changed internal model. (3) An institute which uses internal models after the granted permission of the Bundesanstalt may require the own resources requirements for the Risk categories in accordance with Article 363 (1) of Regulation (EU) No 575/2013 only if there are significant reasons and only after renewed permission of the Bundesanstalt in accordance with Articles 326 to 361 of Regulation (EU) No 575/2013. Permission is to be requested from the institute by stating the reasons for the Federal Institute.

Footnote

(+ + + § 21: For application, see § 1 (1) (1) + + +)

Chapter 2

Specifications for the assessment of the value of the cover

Unofficial table of contents

Section 22 specifications for the measurement of the value of the property of real estate

If an institution for a property wishes to use an insult value in accordance with Article 4 (1) (74) of Regulation (EU) No 575/2013 for the purposes of Articles 92 to 386 of Regulation (EU) No 575/2013, which is subject to strict requirements in accordance with the law, Administrative provisions of the Member States for the assessment of the value of the exposure value shall be subject to the value of the exposure value

-

1.

-

pursuant to § 16 (2) sentences 1 to 3 of the Pfandbrief Act in conjunction with the Ordinance on Mortgage Lending of 12 May 2006 (BGBl. 1175) have been established in the current version,

-

2.

-

have been determined in accordance with the provisions relating to the determination of the deposit value in accordance with Section 7 (7) of the Act on building societies in compliance with a provision approved by the Bundesanstalt pursuant to Section 5 (2) (3) of the Law on Building Savings Banks,

-

3.

-

relate to a property in another State of the European Economic Area and be determined on the basis of strict provisions in force in that State, in accordance with laws, regulations or administrative provisions which the Federal Institute shall use as the be recognised as equivalent to the provisions of the provisions of the Regulation on the determination of the value of the

-

4.

-

a differently determined sustainably achievable value, which satisfies the requirements of § 16 (2) sentence 1 to 3 of the Pfandbrief Act.

Footnote

(+ + + § 22: For application, see § 1 (1) (1) + + +)

(+ + + § 22 Nr 4: For application see Section 38 (1) p. 1 + + +)

Chapter 3

More detailed provisions on the transitional rules for own resources requirements

Unofficial table of contents

§ 23 Percentage of capital ratios

By way of derogation from Article 92 (1) (a) and (b) of Regulation (EU) No 575/2013, in the period from 1 January 2014 to 31 December 2014, the institutions shall have a hard core capital ratio of at least 4 per cent and a core capital ratio of at least 5.5 percent.

Footnote

(+ + + § 23: For application, see § 1 (1) (1) + + +)

Part 3

More detailed rules on the determination of own resources

Chapter 1

More detailed provisions on the transitional rules for the determination of own resources

Unofficial table of contents

§ 24 Percentage of unrealised losses of assets or liabilities recorded in the balance sheet, which are valued at fair value

By way of derogation from Article 35 of Regulation (EU) No 575/2013, in the calculation of the hard core capital in the period from 1 January 2014 to 31 December 2017, the institutions have not published the following percentages of those in their balance sheet Losses realised from assets or liabilities valued at fair value shall be deducted:

-

1.

-

20 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

40 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

60 per cent in the period from 1 January 2016 to 31 December 2016;

-

4.

-

80 percent in the period from 1 January 2017 to 31 December 2017.

Footnote

(+ + + § 24: For application, see § 1 (2) + + +)

Unofficial table of contents

§ 25 Percentage of unrealised gains from assets or liabilities recorded in the balance sheet to be valued at fair value

By way of derogation from Article 35 of Regulation (EU) No 575/2013, in the calculation of the hard core capital during the period from 1 January 2015 to 31 December 2017, the institutions may not publish the following percentages of those in their balance sheet. realised profits from assets or liabilities which are valued at fair value;

-

1.

-

60 per cent in the period from 1 January 2015 to 31 December 2015;

-

2.

-

40 per cent in the period from 1 January 2016 to 31 December 2016;

-

3.

-

20 percent in the period from 1 January 2017 to 31 December 2017.

Footnote

(+ + + § 25: For application, see § 1 (2) + + +)

Unofficial table of contents

§ 26 Percentage of the deductions from the hard core capital, additional core capital and supplementary capital

(1) For the purposes of the transitional provisions referred to in Article 468 (4), 469 (1) (a) and (c), 474 (a) and 476 (a) of Regulation (EU) No 575/2013, the following percentages shall apply:

-

1.

-

20 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

40 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

60 per cent in the period from 1 January 2016 to 31 December 2016;

-

4.

-

80 percent in the period from 1 January 2017 to 31 December 2017.

(2) The percentages referred to in paragraph 1 shall apply in the respective period in accordance with

-

1.

-

the deductions referred to in Article 36 (1) (a) to (h) of Regulation (EU) No 575/2013, with the exception of the deduction of deferred taxes, which are dependent on future profitability and result from time differences;

-

2.

-

the deduction, as laid down in Article 48 of Regulation (EU) No 575/2013, of the aggregate amount of deferred taxes, which are dependent on future profitability and result from time differences,

-

3.

-

the deduction, as required by Article 48 of Regulation (EU) No 575/2013, of the items referred to in Article 36 (1) (i) of Regulation (EU) No 575/2013,

-

4.

-

any prescribed deduction referred to in Article 56 (b) to (d) of Regulation (EU) No 575/2013, and

-

5.

-

any compulsory deduction referred to in Article 66 (b) to (d) of Regulation (EU) No 575/2013.

By way of derogation from the percentages referred to in paragraph 1, the items referred to in Article 36 (1) (c) of Regulation (EU) No 575/2013, which existed before 1 January 2014, shall apply for the purposes of Article 469 (1) (c) of the Regulation (EU) No 575/2013 the following percentages:

-

1.

-

0 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

10 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

20 per cent in the period from 1 January 2016 to 31 December 2016;

-

4.

-

30 per cent in the period from 1 January 2017 to 31 December 2017;

-

5.

-

40 per cent in the period from 1 January 2018 to 31 December 2018;

-

6.

-

50 per cent in the period from 1 January 2019 to 31 December 2019;

-

7.

-

60 per cent in the period from 1 January 2020 to 31 December 2020;

-

8.

-

70 per cent in the period from 1 January 2021 to 31 December 2021;

-

9.

-

80 per cent in the period from 1 January 2022 to 31 December 2022;

-

10.

-

90 per cent in the period from 1 January 2023 to 31 December 2023.

Footnote

(+ + + § 26: For application see § 1 (2) + + +)

Unofficial table of contents

§ 27 Percentage of instruments and positions in the consolidated hard core capital applicable to non-minority shareholdings

(1) By way of derogation from Part 2, Title III of Regulation (EU) No 575/2013, instruments and items which are consolidated in accordance with the first and second sentence of Article 10a (6) of Regulation (EC) No 575/2013 and the first sentence of the first sentence of Article 10a of the Banking Act may be consolidated in the version to be consolidated in the consolidated accounts until 31 December 2013. The following percentages would have been expected and for one of the reasons set out in Article 479 (1) (a) to (d) of Regulation (EU) No 575/2013 are no longer eligible for recognition as a consolidated hard core capital continue to be reckoned with the consolidated hard core capital:

-

1.

-

80 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

60 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

40 per cent in the period from 1 January 2016 to 31 December 2016;

-

4.

-

20 percent in the period from 1 January 2017 to 31 December 2017.

(2) By way of derogation from paragraph 1, instruments and items which, in accordance with Section 10a, paragraph 6, sentence 10 of the Banking Act, would have been included in the consolidated reserves in force until 31 December 2013 and from one of the items referred to in Article 479 may be taken into account. (1) (a) to (d) of Regulation (EU) No 575/2013 are no longer eligible for recognition as consolidated hard core capital in the application of the provisions of Part 2, Title III of Regulation (EU) No 575/2013, during the period from 1 January 2014 to 31 December 2017 no longer to the consolidated hard core capital expected.

Footnote

(+ + + § 27: For application, see § 1 (2) + + +)

Unofficial table of contents

§ 28 Factors for the recognition of minority shareholdings and qualified additional core capital as well as supplementary capital

By way of derogation from Article 84 (1) (b), Article 85 (1) (b) and Article 87 (1) (b) of Regulation (EU) No 575/2013, the percentages referred to therein shall be in the period from 1 January 2014 to 31 December 2017, with the following: Multiply factors:

-

1.

-

factor 0.2 in the period from 1 January 2014 to 31 December 2014;

-

2.

-

the factor of 0.4 in the period from 1 January 2015 to 31 December 2015;

-

3.

-

the factor 0.6 in the period from 1 January 2016 to 31 December 2016;

-

4.

-

the factor 0.8 in the period from 1 January 2017 to 31 December 2017.

Footnote

(+ + + § 28: For application cf. § 1 (2) + + +)

Unofficial table of contents

§ 29 Percentage of the deductions provided for in Articles 32 to 36, 56 and 66 of Regulation (EU) No 575/2013

(1) By way of derogation from Articles 32 to 36, 56 and 66 of Regulation (EU) No 575/2013, for the period from 1 January 2014 to 31 December 2017, the adjustments required by institutions in Article 481 (1) of Regulation (EU) No 575/2013 shall apply: for deductions which are required in accordance with the second sentence of Article 10 (2a), the first sentence of paragraph 6, the first sentence of paragraph 6 and the provisions of paragraph 6a (1), (2) and (4) of the Banking Act, as amended by 31 December 2013, the following percentages are as follows:

-

1.

-

80 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

60 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

40 percent in the period from 1 January 2016 to 31 December 2016 and

-

4.

-

20 percent in the period from 1 January 2017 to 31 December 2017.

(2) For the application of the provisions of Articles 32 to 36, 56 and 66 of Regulation (EU) No 575/2013, for the period from 1 January 2014 to 31 December 2017 for the provisions of Article 10a (6) sentence 9 of the Banking Act in the period up to 31 December 2013. (3) The difference in the amount of the difference between the financial statements of the consolidated financial statements in accordance with § 2 (1) of the Consolidated Financial Regulation as amended by 31 December 2013 in the supplementary capital. shall be eligible for consideration in the period from 1 January 2014 to 31 December 2017 multiplied by the following percentages shall continue to be added to the supplementary capital:

-

1.

-

80 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

60 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

40 percent in the period from 1 January 2016 to 31 December 2016 and

-

4.

-

20 percent in the period from 1 January 2017 to 31 December 2017.

Footnote

(+ + + § 29: For application, see § 1 (2) + + +)

Unofficial table of contents

Section 30 Percentage of the adjustment referred to in Article 36 (1) (i) and 49 (1) and (3) of Regulation (EU) No 575/2013

By way of derogation from Articles 36 (1) (i) and 49 (1) and (3) of Regulation (EU) No 575/2013, the derogation referred to in Article 481 (2) of Regulation (EU) No 575/2013 shall apply in the period from 1 January 2014 to 31. December 2014, a percentage of 50 percent.

Footnote

(+ + + § 30: For application, see § 1 (2) + + +)

Unofficial table of contents

§ 31 Percentage limits on the instruments of the hard core capital, additional core capital and additional capital, covered by the protection of the stock, in accordance with Article 484 (3) to (5) of Regulation (EU) No 575/2013

For the purposes of applying Article 484 (3) to (5) of Regulation (EU) No 575/2013, the period from 1 January 2014 to 31 December 2021 shall apply to the recognition of the instruments and items of hard core capital falling within the scope of the protection of the stocks, the additional core capital and supplementary capital, the following percentages:

-

1.

-

80 per cent in the period from 1 January 2014 to 31 December 2014;

-

2.

-

70 per cent in the period from 1 January 2015 to 31 December 2015;

-

3.

-

60 per cent in the period from 1 January 2016 to 31 December 2016;

-

4.

-

50 per cent in the period from 1 January 2017 to 31 December 2017;

-

5.

-

40 per cent in the period from 1 January 2018 to 31 December 2018;

-

6.

-

30 per cent in the period from 1 January 2019 to 31 December 2019;

-

7.

-

20 per cent in the period from 1 January 2020 to 31 December 2020;

-

8.

-

10 per cent in the period from 1 January 2021 to 31 December 2021.

Footnote

(+ + + § 31: For application, see § 1 (2) + + +)

Chapter 2

Treatment of participations assessed according to the equivalence method in groups

Unofficial table of contents

Section 32 Treatment of the participations assessed in accordance with the equivalence method in application of the procedure in accordance with Section 10a (5) of the Banking Act

(1) participations in institutions, financial undertakings or ancillary services providers subject to the equivalence method in accordance with IAS 28.13, as amended by Commission Regulation (EC) No 1725/2003 of 29 September 2003 on the adoption of certain international accounting standards in accordance with Regulation (EC) No 1606/2002 of the European Parliament and of the Council (OJ L 327, 30.4.2002, p. 1), subject to the application of Article 10a (4) of the Banking Act, may, with its pro-rata, balance sheet capital, be differentiated according to the capital adequacy of the financial statements. Summary according to § 10a paragraph 5 of the Banking Act. The continued carrying amount of the holding determined in accordance with the equivalence method shall be deducted from the hard core capital of the group, with the goodwill contained therein in the deduction position referred to in Article 36 (1) (b) of Regulation (EU) No (2), paragraph 1 shall apply, in accordance with the use of a financial statements which are not in accordance with the accounting standards referred to in Articles 2, 3 and 6 of Regulation (EC) No 1606/2002 of the European Parliament and of the Council of 19 July 2002 on the application of international accounting standards (OJ C 139, 30.4.2002, p . 1) was adopted and adopted.

Footnote

(+ + + § 32: For application, see § 1 (3) + + +)

Part 4

More detailed provisions on the countercyclical capital buffer and the combined capital buffer requirement

Chapter 1

Anticyclic Capital Buffer

Unofficial table of contents

Section 33 Definition of the quota for the domestic countercyclical capital buffer

(1) In order to determine the quota for the domestic countercyclical capital buffer in accordance with § 10d of the German Banking Act, the Federal Institute shall establish a buffer guideline value for the quarter. This reflects in a meaningful way the credit cycle and the risks arising from excessive credit growth in Germany and takes account of the specific economic conditions within the scope of the credit law. The indicative buffer value is based on the deviation of the ratio of domestic loans to gross domestic product (credit-to-GDP ratio) from the long-term trend. When determining the buffer guideline, the Bundesanstalt takes into account:

-

1.

-

an indicator of domestic credit growth and, in particular, an indicator reflecting changes in the credit-to-GDP ratio;

-

2.

-

any recommendations on the measurement and calculation of the deviation of the credit-GDP ratio from the long-term trend and the determination of the buffer benchmarks of the European Systemic Risk Board in accordance with Article 16 of Regulation (EU) No 1092/2010 of the European Parliament and of the Council of 24 November 2010 on the financial supervision of the European Union at the macro level and on the establishment of a European Systemic Risk Board (OJ L 327, 28.12.2010, p. 1), as amended.

In determining and evaluating the quota for the anti-cyclical capital buffer, the Bundesanstalt shall also take into account any recommendations which may be made by the European Systemic Risk Board in accordance with Article 135 (1) of the Directive 2013 /36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activities of credit institutions and the supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing the Directives 2006 /48/EC and 2006 /49/EC (OJ L 206, 22.7.2006, OJ L 176, 27.6.2013, p.338).

Footnote

(+ + + § 33: For application, see § 1 (4) + + +)

Unofficial table of contents

Section 34 Publication of the quota

In the cases of § 10d (3) and (4) of the Banking Act, the Bundesanstalt publishes the quota for the domestic counter-cyclical capital buffer on its website, which is fixed for the respective quarter. In addition, at least the following additional information shall be published:

-

1.

-

the relevant credit-to-GDP ratio and its deviation from the long-term trend,

-

2.

-

the indicative buffer value in accordance with § 33 (1),

-

3.

-

a justification for the quota for the domestic counter-cyclical capital buffer;

-

4.

-

in the case of an increase in the quota for the domestic countercyclical capital buffer, the date from which the institutions must use this higher rate for the calculation of their institution-specific anti-cyclical capital buffer,

-

5.

-

in cases where the date referred to in point 4 is less than 12 months after the date of publication of this increase in the quota for the domestic countercyclical capital buffer as set out in the first sentence, the exceptional circumstances which result in a shorter period of time the time limit for the application,

-

6.

-

in the case of a reduction in the quota for the domestic countercyclical capital buffer, the period during which no increase in the quota for the domestic counter-cyclical capital buffer is to be expected and justification therefor.

Footnote

(+ + + § 34: For application, see § 1 (4) + + +)

Unofficial table of contents

Section 35 Additional publications for quotas in third countries

In addition to the information to be published pursuant to Section 10d (9) of the Banking Act, the Bundesanstalt publishes an explanatory statement in the case of § 10d (6) of the German Banking Act (Kreditwesengesetz) for the recognition of the status of the third country , and in the cases of Article 10d (7) and (8) of the Banking Act, a justification for determining the quota for the countercyclical capital buffer.

Footnote

(+ + + § 35: For application, see § 1 (4) + + +)

Unofficial table of contents

§ 36 Scale-up risk positions

(1) The relevant risk positions within the meaning of Article 10d (2) of the Banking Act shall include any risk position which does not belong to any of the exposure classes referred to in Article 112 (a) to (f) of Regulation (EU) No 575/2013 and for which one of the following categories of exposures is included in the the following conditions are met:

-

1.

-

it is subject to the own resources requirements for credit risks in accordance with Articles 107 to 311 of Regulation (EU) No 575/2013,

-

2.

-

the risk position shall be kept in the trading book, the own resources requirements for specific risks referred to in Articles 326 to 350 or additional risk of default and migration shall be laid down in accordance with Articles 362 to 377 of Regulation (EU) No 575/2013 to apply,

-

3.

-

If the risk position is a securitisation, the own resources requirements shall be applied in accordance with Articles 242 to 270 of Regulation (EU) No 575/2013.

(2) For the purposes of the calculation prescribed in § 10d (2) of the Banking Act

-

1.

-

the revised quota for the anti-cyclical capital buffer for a State of the European Economic Area should be applied in the event of its increase from the date published in accordance with Article 34 or Article 10d (9) of the Banking Act. information is given;

-

2.

-

, a revised quota for the anti-cyclical capital buffer for a third country should be applied in the event of its increase, subject to point 3, from the date on which the competent authority in the third country has a change 12 months after the date on which the competent authority is the quota for the anti-cyclical capital buffer has been disclosed, irrespective of whether that authority is required by the institutions established in the third country concerned to apply such a change within a shorter period;

-

3.

-

the quota for the anti-cyclical capital buffer in cases where the Bundesanstalt establishes the quota for the countercyclical capital buffer for a third country or the rate applicable to the anti-cyclical capital for a third country recognition of capital buffers and the establishment or recognition of an increase in the previously applicable quota, as from the date specified in the information published in accordance with Section 10d (9) of the Banking Act;

-

4.

-

a quota shall apply to the anti-cyclical capital buffer in the event of a reduction of the quota from the decision on the reduction of the quota.

For the purposes of point 2 of the first sentence, a change in the rate of the countercyclical capital buffer for a third country shall be deemed to have been notified as from the date on which it shall be notified by the competent authority in that third country, in accordance with the conditions laid down in that third country. (3) The institution shall determine, in accordance with Article 10d (2) of the Banking Act, the existence of a substantial credit commitment, taking into account any legal acts adopted by the European Commission for this purpose, on the basis of Regulation (EU) No 1093/2010 of the European Parliament and of the Council of 24 November 2010 on the establishment of a European Supervisory Authority (European Banking Authority), amending Decision No 716 /2009/EC and repealing Commission Decision 2009 /78/EC (OJ L 136, 31.7.2009, p. 12), as amended, have been adopted.

Footnote

(+ + + § 36: For application, see § 1 (4) + + +)

Chapter 2

Combined Capital Buffer Request

Unofficial table of contents

§ 37 Maximum payout amount

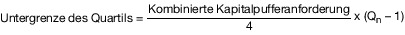

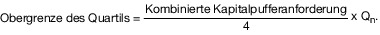

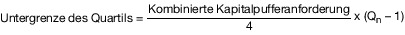

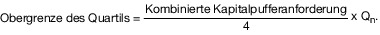

(1) The maximum amount to be paid out within the meaning of Article 10i (3) of the Banking Act shall be calculated by multiplying the amount calculated in accordance with paragraph 2 by the factor determined in accordance with paragraph 3. It is reduced by any measure implemented in accordance with Article 10i (3), third sentence, points 1 to 3 of the Banking Act. (2) The amount to be multiplied shall be determined by the following:

-

1.

-

the intermediate gains which are not included in the core capital referred to in Article 26 (2) of Regulation (EU) No 575/2013 and which, after the final decision on the distribution of the profits, or any of those referred to in Article 10i (3), third sentence, points 1 to 3 of the The measures listed above have been generated;

-

2.

-

plus the profits at the end of the year not included in the core capital referred to in Article 26 (2) of Regulation (EU) No 575/2013 and which shall be made after the final decision on the distribution of profits or any of those referred to in Article 10i (3), third sentence, until three of the measures listed in the Banking Act were generated;

-

3.

-