Regulation on contributions to the compensation facility of German banks GmbH (EdB Contribution Regulation-EdBBeitrV)

Unofficial table of contents

EdBBeitrV

Date of completion: 10.07.1999

Full quote:

" EdB-Contribution Ordinance of 10 July 1999 (BGBl. 1540), as last amended by Article 5 of the Regulation of 30 January 2014 (BGBl I). 322) has been amended "

| Status: |

Last amended by Art. 5 V v. 30.1.2014 I 322 |

For more details, please refer to the menu under

Notes

Footnote

(+ + + Text evidence from: 17.7.1999 + + +)

Headline: Short name and name Letter abbreviation inserted. by Art. 1 No. 1 V v. 17.8.2009 I 2879 mWv 26.8.2009

Unofficial table of contents

Input formula

On the basis of § 8 (3) sentence 1 and 2 of the Deposit Guarantee and Investor Compensation Act of 16 July 1998 (BGBl. 1842), the Federal Ministry of Finance, after hearing the compensation institution of German banks, is responsible for:

Unofficial table of contents

§ 1 Annual contribution

(1) Institutions assigned to the compensation facility of deutscher Banken GmbH shall contribute an annual contribution to the compensation facility at the latest on 30 September at the latest. The annual contribution of an institution shall be 0.016 per cent of the balance sheet position of "liabilities to customers" of its last annual financial statements multiplied by the credit factor of that institution in accordance with § 4 (2) or 3, but at least 15 000 euro. In the assessment of the contribution, the following items in the balance sheet item "liabilities to customers" may not be taken into account:

-

1.

-

Mortgage-Name Pfandbriefe,

-

2.

-

public name-to-name letters,

-

3.

-

other name bonds, which are subject to the conditions laid down in Article 52 (4) of Directive 2009 /65/EC of the European Parliament and of the Council of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to certain Undertakings for collective investment in transferable securities (UCITS) (OJ L 136, 30.4.2004, p. OJ L 302, 17.11.2009, p.32, L 269, 13.10.2010, p.27),

-

4.

-

Management companies within the meaning of Article 1 (14) of the Capital Investment Code, having its head office in Germany or abroad, including the domestic and foreign investment assets they manage within the meaning of Article 1 (1) of the Capital Investment Code,

-

5.

-

liabilities to private and public insurance undertakings,

-

6.

-

Liabilities to the Federal Government, a country, a non-legally independent special fund of the Federal Government or of a country, a local authority, another State or a regional government or local authority of a other State,

-

7.

-

Liabilities to companies which form a group with the Institute within the meaning of Section 18 of the German Stock Corporation Act, without the legal form of the company being required to do so,

-

8.

-

Liabilities arising from securities exchange transactions,

-

9.

-

return obligations arising from securities lending operations,

-

10.

-

liabilities that are not denominated in the currency of a Member State of the European Union or euro; and

-

11.

-

in the case of building societies, the amount of the funds allocated to the special item "Fonds zur bauspartechnische safeguard" pursuant to section 6 (1) of the law on building savings banks is 10 times in terms of amount.

Where an institution makes use of the option provided for in the third sentence, it shall provide proof of the level of the deductions from an auditor or an accounting firm, provided that such evidence does not form part of the balance sheet of the (1a) In the case of an institution which is compulsorly another compensation institution within the meaning of Article 3 (1) of Directive 94 /19/EC of the European Parliament and of the Council of 30 May 1994 on Deposit Guarantee Schemes 1. 5) or Article 2 (1) of Directive 97 /9/EC of the European Parliament and of the Council of 3 March 1997 on investor-compensation schemes (OJ L 378, 27.11.1997, p. 22), it is possible, upon application for the calculation of the annual contribution from the balance sheet position "liabilities to customers", to withdraw liabilities from the scope of the protection of the other The invention relates to a compensation device. Where an institution makes use of the option provided for in the first sentence, it shall have to provide proof of the level of the drawn-off positions confirmed by an auditor or an accounting firm, in so far as it does not form part of the balance sheet of the (2) In place of the annual contribution provided for in paragraph 1, institutions may make an annual contribution of 1.1 per cent of the potential scope of the compensation claims in accordance with § 4 of the Deposit Guarantee and Investor Compensation Act at the time of the last annual financial statements prepared before 1 July multiplied by their creditworthiness factor in accordance with Article 4 (2) or (3), but at least EUR 15 000, provided that they have been confirmed by a chartered accountant or an accounting firm of this potential (3) All institutions assigned to or assigned to the compensation institution in the respective accounting year shall be independent of the duration of the assignment. (4) The contribution of an institution shall end as soon as

-

1.

-

the Bundesanstalt für Finanzdienstleistungsaufsicht (Bundesanstalt für Finanzdienstleistungsaufsicht) has determined the case of compensation in accordance with Article 5 (1) of the Deposit Insurance and Investor Compensation Act and this finding has become indisputable or

-

2.

-

the permission of the Institute has been revoked or returned.

(5) The annual contribution of an institution shall not exceed 0.6 per cent of its own funds in accordance with Article 72 of Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions, and Investment firms and amending Regulation (EU) No 646/2012 (OJ L 46, 2.2.2012, p. OJ L 176, 27.6.2013, p. 1).

Unofficial table of contents

§ 2 One-off payment

(1) Institutes assigned to the compensation facility after August 1, 1998 shall have, in addition to the annual contribution according to § 1, a one-off payment in the amount of 0.1 percent of the balance sheet position 'liabilities to customers' on the basis of of their last annual accounts, if they have already drawn up annual accounts for three full financial years as CRR credit institutions in accordance with Section 1 (1) (1) of the Deposit Guarantee and Investor Compensation Act. Section 1 (1a) shall apply accordingly. Instead of the one-off payment under sentences 1 and 2, the institutions may pay a one-off payment of 12 percent of the potential scope of the compensation claims in accordance with § 4 of the Deposit Guarantee and Investor Compensation Act to the At the time of the last annual financial statements, provided that they provide evidence, confirmed by a chartered accountant or an accounting firm, of this potential extent to the compensation facility. In any case, the one-time payment shall be at least EUR 30 000. The one-off payment is due upon the announcement of the date of the one-off payment. (2) Institutes that do not yet have annual financial statements for three full financial years as CRR credit institution in accordance with § 1 para. 1 No. 1 of the Deposit Guarantee and In accordance with the provisions of the Investor compensation Act, the one-off payment referred to in paragraph 1 shall be made on the basis of the annual financial statements of the third full financial year, but at least EUR 30 000. In the case of allocation to the compensation institution, these institutions shall make an advance payment of the minimum payment of EUR 30 000. The advance payment shall be due upon the announcement of a provisional date of payment of the one-off payment. Upon presentation of the annual financial statements for the third full financial year as CRR credit institution in accordance with § 1 (1) No. 1 of the Deposit Insurance and Investor Compensation Act, a resulting difference shall be repaid, which shall be announced with the announcement of the financial statements of the final decision on the one-time payment is due. The obligation laid down in the fourth sentence shall also apply if the institution departs from the compensation facility before the third full financial year has been reached. If, at the time of the preparation of the annual financial statements for the third full financial year, the institution no longer operates within the territorial scope of the Deposit Guarantee and Investor Compensation Act, the institution shall replace the annual financial statements for the third full financial year. the third full financial year of the financial statements for the full financial year, in which the institution was the last year in the territorial scope of the deposit guarantee and investor compensation law. (3) For the calculation of the one-time payment shall be made by the institution upon request by the Compensation institution shall make available immediately, within two weeks at the latest, the balance sheet of the compensation institution to be used.

Unofficial table of contents

§ 3 Modification of the one-time payment

(1) The institutions associated with the compensation institution, which have been created by re-establishment by the merger of institutions formerly belonging to the compensation institution, shall be exempted from the one-off payment, provided that the former (2) If the institutions formerly belonging to the compensation institution have not made any annual contributions in the year to be taken, the associated institution shall be responsible for the following: Institute obligated to make a one-off payment at the level of (3) paragraphs 1 and 2 shall apply in accordance with the institutions assigned to them, and (3) the accounts of the institutions responsible for the compensation of the institutions, that have been created by division or otherwise by transfer of wealth. In the case of division, the payment referred to in paragraph 2 shall be made pro rata by the institutions involved.

Unofficial table of contents

§ 4 (omitted)

Unofficial table of contents

§ 4 Determination of the creditworthiness factor

(1) For the purpose of determining the creditworthiness factor, the compensation institution shall carry out a credit assessment of the institutions responsible for contributing to the credit rating. It has to determine a credit rating for each institution, which must be based on a credit rating according to § 5 and 50 per cent on a key performance assessment based on credit ratings based on credit ratings according to § 6. (2) The creditworthiness rating of the respective institute is as follows for the assessment of the contribution rate of the respective institution:

Credit note123456789

| Credit Factor |

0.75 |

0.9 |

1.0 |

1.1 |

1.25 |

1.4 |

1.6 |

1.8 |

2.0 |

(3) Notwithstanding paragraphs 1 and 2 of paragraphs 1 and 2, the credit factor 1.1 shall apply to newly established institutions in the first two years of complete financial years. § § 5 to 7 shall not apply to this extent.

Unofficial table of contents

§ 5 Credit assessment on the basis of key figures

(1) The compensation institution shall assess the credit rating on the basis of the Institute's performance, financial and earnings situation in accordance with the provisions of Appendix 1 to this Regulation. (2) The institutions shall be obliged to: Compensation institution for the preparation of the credit assessment shall transmit the following documents and data:

-

1.

-

the annual financial statements within the meaning of the first and second sentences of Article 26 (1) of the Banking Act of the financial year concluded before 1 March of the respective accounting year and of the previous year or the corresponding financial statements with Expense and revenue account and notes in accordance with Section 53 (2) (2) of the Banking Act,

-

2.

-

the summary statement relating to own resources in accordance with Article 72 of Regulation (EU) No 575/2013 in conjunction with Article 10a of the Banking Act (Reporting Form E UEB or Q UEB pursuant to Annex 3 of the Solvency Regulation) on the balance sheet date of the prior to 1 March of the the financial year for each financial year, as well as the balance sheet date of the previous year; and

-

3.

-

the completed questionnaire of the compensation facility for the collection of supplementary information.

The annual financial statements or the balance sheet shall be accompanied by an unqualified audit opinion of the auditor. An annual financial statement or a balance sheet with a limited audit opinion shall only be taken into account by the compensation institution if the objections of the auditor are not the same as those for the credit rating relevant key figures as set out in Annex 1, point 1.

Unofficial table of contents

§ 6 Credit rating on the basis of ratings

(1) The compensation institution shall accept the credit rating on the basis of credit ratings in accordance with Annex 2 to this Regulation. (2) The credit assessment shall only be subject to credit rating results of current credit ratings of a recognised Rating company in the form of full ratings with a forecasting period of one year. Current ratings within the meaning of the first sentence are those which, on behalf of the Institute or a third party, relate to the creditworthiness of the institution from 1 July of the previous accounting year and no later than 30 June of the current financial year. The accounting year has not yet expired and its forecast period has not yet expired. Where a number of credit rating results within the meaning of the first and second sentences are available for an institution, the institution shall be weighted by the compensation institution in accordance with Annex 2 to this Regulation. (3) Credit rating undertakings recognised as defined in the first sentence of paragraph 2 shall be Undertakings acting as credit rating agencies in accordance with Article 14 of Regulation (EC) No 1060/2009 of the European Parliament and of the Council of 16 September 2009 on credit rating agencies (OJ L 327, 30.12.2009, p. OJ L 302, 17.11.2009, p. 1, L 350, 29.12.2009, p. 59 and L 145, 31.5.2011, p. 57), as amended in each case, or certified in accordance with Article 5 of this Regulation, and

-

1.

-

have experience with credit rating of CRR credit institutions for at least five years, or

-

2.

-

for at least 10 years, credit assessments have been made for backup facilities of CRR credit institutions.

(4) Each credit assessment category used by a recognised rating company shall assign the compensation institution to a credit rating referred to in Article 4 (2). In the case of allocation, the compensation institution shall apply the principles laid down in Article 54 (3) to (6) of the Solvency Regulation accordingly. The compensation institution shall publish the assignment on the Internet. (5) The institutions shall be obliged to provide the compensation facility for the preparation of the credit assessment of all the current ratings referred to in the first sentence of the second sentence of paragraph 2 and 2. If institutions do not have an up-to-date rating, they are obliged to obtain such a rating on the basis of the compensation facility. Sentence 2 shall not apply to institutions within the meaning of Article 53 (1), first sentence, of the Banking Act, which shall submit a credit rating of their company based abroad if that credit rating meets the requirements of the first and second sentences of paragraph 2.

Unofficial table of contents

§ 7 Preliminary obligation, provisional fixing and time limit for exclusion

(1) The institutions shall be obliged to provide the compensation institution with the information required to determine the balance sheet position "liabilities to customers" and the credit rating in accordance with § 1 (1) sentence 2, § 5 (2) and § 6 (5). To submit documents by 1 July of the respective accounting year. If an institution does not or does not complete the necessary information and documents within the time limit set out in the first sentence, the compensation facility shall be entitled to fix the annual contribution on a provisional basis. If an institution does not submit the annual financial statements required for the determination of the balance sheet position "liabilities to customers" within the meaning of the second sentence of Article 1 (1), or does not result from the annual accounts submitted, the Balance sheet "payable to customers", the compensation facility is empowered to take this position, taking into account the size and structure of the institution's operations and a group of comparable institutions, on the basis of appropriate To estimate the documents. If an institution does not submit the information and documents required for the assessment of the creditworthiness in accordance with § 5 (2) and § 6 (5) by the deadline, the credit rating note 9 applies to the institute in relation to the current accounting year. (2) Information and documents referred to in the first sentence of paragraph 1, which shall be submitted after 31 December of the following accounting year, shall no longer be taken into account. At the end of this period, the compensation institution shall, in conclusion, determine the contribution, taking into account the documents submitted by 31 December on the balance sheet item "Liabilities to customers"; the credit note referred to in paragraph 1 Sentence 4 shall be deemed to be a final grade of credit, provided that the institution has not provided the necessary information and documents for the assessment of the creditworthiness up to the end of the period. (3) The time limit referred to in the first sentence of paragraph 2 shall be an exclusion period.

Unofficial table of contents

§ 8 Transitional provision

(1) § 1 in the version valid from 26 August 2009 applies for the first time to the collection of annual contributions for the accounting year 2008/2009. (2) In the case of institutions that have been assigned to the compensation institution before 26 August 2009, (3) § 1 in the version in force as of 16 December 2011 is for the first time on the collection of annual contributions for the Accounting year 2011/2012 to be applied. The one-off payment shall be made in the case of institutions which have been assigned to the compensation facility before 16 December 2011, in accordance with § § 2 and 3 of this Regulation in the version valid until 15 December 2011.

Unofficial table of contents

Section 9 Entry into force

This Regulation shall enter into force on the day after the date of delivery.

Unofficial table of contents

Appendix 1 (to § 5 (1) and 2 sentence 3)

(Fundstelle: BGBl. I 2011, 2687-2688)

Credit assessment on the basis of key figures

-

1.

-

The following key figures are included in the measure-related credit rating:

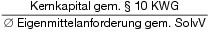

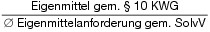

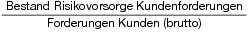

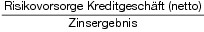

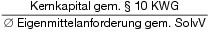

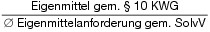

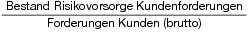

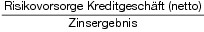

Measure Weight Ratio

| Core capital ratio |

0.61% |

|

| Own resources ratio |

4.30% |

|

| Risk prevention rate |

6.81% |

|

| Risk Feed Rate |

3.64% |

|

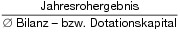

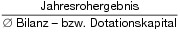

| Equity profitability |

3.96% |

|

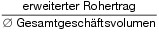

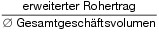

| Gross Profitability |

4.94% |

|

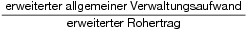

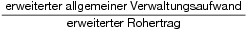

| Cost coverage rate |

2.71% |

|

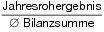

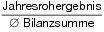

| Net profitability |

1.84% |

|

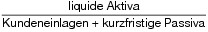

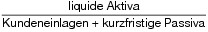

| Liquidity ratio |

9.21% |

|

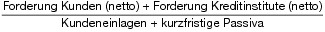

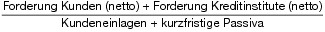

| Refinancing rate |

5.33% |

|

| Asset sensitivity securities |

6.06% |

|

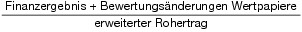

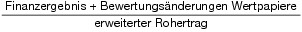

| Results-sensitivity securities |

0.59% |

|

| |

50.00% |

|

The proportion of the key figures in the credit note in accordance with Section 4 (1), second sentence, shall be determined by their weight in accordance with column 2 of the above table.

-

2.

-

Description of the ratio quotients as defined in column 3 of the above table:

-

-

-

Core capital referred to in Article 25 of Regulation (EU) No 575/2013: core capital according to the information provided in the summary statement on the own resources referred to in Article 72 of Regulation (EU) No 575/2013 in conjunction with Section 10a of the KWG (Reporting Form E UEB or Q UEB ID number 1.4 of the Appendix 3 to SolvV)

-

-

-

Ø own resources requirement according to. Solvv: (previous year + reference year) /2 according to the information provided in the overview sheet on the own resources referred to in Article 72 of Regulation (EU) No 575/2013 in conjunction with Section 10a KWG (Reporting Form E UEB or Q UEB ID number 2 of Appendix 3 to SolvV)

-

-

-

Own resources referred to in Article 72 of Regulation (EU) No 575/2013: own resources as a whole, in accordance with the information provided in the summary statement on the own resources referred to in Article 72 of Regulation (EU) No 575/2013 in conjunction with Section 10a of the KWG (Reporting Form E UEB or Q UEB). ID number 1 of Appendix 3 to SolvV)

-

-

-

Inventory Risk Reduction Customer Requirements: Inventory Single-value adjustment Customers + Inventory Flat-rate adjustment Customers

-

-

-

Receivings Customers (gross): Balance sheet position receivings to customers plus the amount of individual and flat-rate correction Customers and taxed general reserves

-

-

-

Risk provisions Credit business (net): Saldiated valuation result in the credit business without taking into account a compensation with the valuation result of securities of the liquidity reserve (cross-compensation)

-

-

-

Interest income: balance from the position of interest income in accordance with § 28 of the RechKredV and interest expense in accordance with § 29 of the RechKredV (excluding current income from shares and other non-fixed-income securities, shareholdings, shares in affiliated companies) Company)

-

-

-

Annual gross profit: result of normal operating activities before taxes plus extraordinary result

-

-

-

Ø Balance sheet or Endowment capital: (previous year + reference year) /2, equity according to form 1 of the RechKredV

-

-

-

Extended gross profit: result of normal operating activities before taxes adjusted for the valuation result in the credit business, general administrative expenses as well as depreciation and impairment of intangible assets and Tangible assets

-

-

-

Ø Total business volume: (previous year + reporting year) /2, gross balance sheet total (=balance sheet total incl. Risk management stock) + other off-balance-sheet business incl. Provisions pursuant to Article 19 (1) of the KWG

-

-

-

Extended general administrative burden: General administrative burden according to § 31 RechKredV + depreciation and impairment of intangible fixed assets and property, plant and equipment according to form 2 of the RechKredV + non-profit-independent taxes according to Form 2 of the RechKredV

-

-

-

Ø Balance sheet total: (previous year + reference year) /2, balance sheet total according to balance sheet pass

-

-

-

Cash assets: cash reserve + refinancing debt securities + receivables customers and credit institutions with a remaining term of up to three months + securities of the liquidity reserve + securities of the trading stock

-

-

-

Customer deposits: liabilities to customers with a residual maturity of up to three months

-

-

-

Short-term liabilities: liabilities to credit institutions with a residual maturity of up to three months + trading assiva + securitised liabilities with a residual maturity of up to three months

-

-

-

Demand customers (net): demand for customers according to the accounting certificate

-

-

-

Requirement credit institutions (net): demand credit institutions in accordance with balance sheet pass

-

-

-

Securities: debt securities and other fixed-income securities + shares and other non-fixed-income securities + trading stock (all in accordance with the balance sheet card)

-

-

-

Credit equivalents: amounts with which derivatives are to be credited as credit in accordance with § § 13 and 14 KWG in conjunction with Article 387 of Regulation (EU) No 575/2013 (according to GroMiKV)

-

-

-

Financial result: Net income from financial transactions in accordance with Form 2 of the RechKredV

-

-

-

Valuation changes Securities: valuation result of the securities of the liquidity reserve (analogous to § 32 RechKredV) + valuation result of the securities of the fixed assets (analogous to § 33 RechKredV).

-

3.

-

The basis for the determination of the key figures are the ratios of the assets, financial position and profit situation at the end of the last financial year concluded before 1 March of the respective accounting year. The financial data to be taken into account in accordance with point 1 shall be based on the annual accounts of the Institute in accordance with § 5 (2) sentence 1 and 2, respectively. the corresponding balance sheet with the revenue and expenditure account and the appendix in accordance with Section 53 (2) (2) of the KWG. For the use of the so-called waiver scheme in accordance with § 2a KWG, the ratios of the core capital ratio and the equity ratio are taken into account at the group level. In the case of institutions which fall under the provisions of Section 53c (2) of the KWG, the ratios of the core capital ratio and the own resources ratio are taken into account for the key ratios of the head office.

-

4.

-

The key figures are developed using mathematical-statistical methods (discriminant analysis) to an optimized function, which are adapted as far as necessary in the context of regular validation and backtesting procedures. is being developed.

Unofficial table of contents

Appendix 2 (to § 6 (1))

(Fundstelle: BGBl. I 2011, 2689)

Credit assessment on the basis of ratings

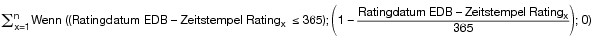

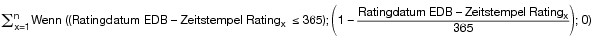

The rating results will be included in the credit rating in the form of a weighted average. The weighting of a number of incoming rating results depends on their topicality. The younger the rating result is, the stronger its weight. The calculation of the weighted average is carried out in four steps: Step 1Determination of the age of all ratings to be taken into account for an institution with a maturity of ≤ 365 days: F (age of all ratings) =

Step 2Determination of the weight of the credit rating, based on each rating to be taken into account for an institution: F (weight of the rating x) =

The sum of the individual weights of the ratings must always result in 1.

Step 3 Determination of the weighted average of the credit rating, based on each rating to be taken into account for an institution: F (weighted average of the Ratingsx) =

Point value Ratingx * F (weight of the Ratingsx) Step 4Determination of the weighted average of the ratings: F (weighted average of the ratings) =

The following parameters shall be taken into account for the determination in steps 1 to 4:

-

-

-

Rating Date EDB = EdB Ratings Creation Time

-

-

-

Time stamp Ratingx = Publication date per rating

-

-

-

x = Rating 1, Rating 2, ..., Rating n

-

-

-

A corresponding point value is assigned to the rating result via a transformation matrix.

-

-

-

Age of Ratingsx = (rating date EDB time stamp Ratingx)

The results of the rating are developed using mathematical-statistical methods (discriminant analysis) into an optimized function, which are adapted to the extent necessary in the framework of regular validation and backtesting procedures and is being developed.

Step 2Determination of the weight of the credit rating, based on each rating to be taken into account for an institution: F (weight of the rating x) =

Step 2Determination of the weight of the credit rating, based on each rating to be taken into account for an institution: F (weight of the rating x) =

The sum of the individual weights of the ratings must always result in 1.

The sum of the individual weights of the ratings must always result in 1.

The following parameters shall be taken into account for the determination in steps 1 to 4:

The following parameters shall be taken into account for the determination in steps 1 to 4: